Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: U.S. job vacancy weakens + bond market volatility slows down, and the pound rebounds to catch a breath! The US dollar range fluctuates toward the end." Hope it will be helpful to you! The original content is as follows:

Asian market market

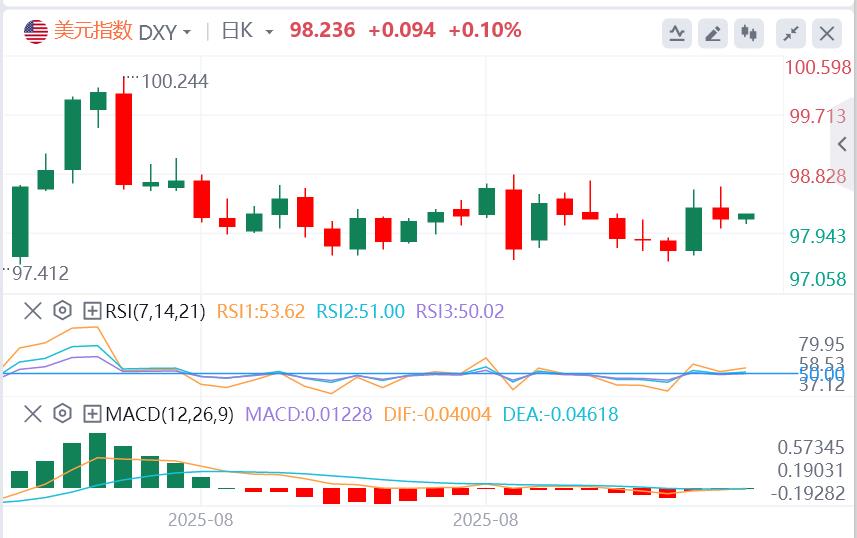

On Wednesday, the US dollar index fluctuated above the 98 mark. The US market fell sharply due to career vacancy data showing weak recruitment of enterprises. As of now, the US dollar price is 98.23.

1. Fed

① Waller: I believe we should cut interest rates at the next meeting. There may be multiple interest rate cuts in the future, but the specific pace depends on the data.

②Musalem: The current interest rate is just right, but the employment market is risky.

③Bostic: I am worried about inflation and still think it is appropriate to cut interest rates once this year.

④The Federal Reserve will hold a payment innovation meeting on October 21, which will discuss stablecoins, artificial intelligence and tokenization.

⑤Federal Director Nominee Milan: If the nomination is confirmed, it will maintain FOMC independence.

⑥ Kashkali: There is still room for a moderate reduction in interest rates.

⑦Federal Beige Book: Economic activities remain basically the same, and businesses and households feel the impact of tariffs.

2. Tariffs

① Trump plans to impose tariffs on countries that regulate U.S. technology oalcs.cnpanies, and sources say the main target of the threat is South Korea rather than Europe.

②Indian Trade Minister: Hope to reach a bilateral trade agreement with the United States by November.

③The Canadian Prime Minister said the dialogue with Trump was "good" but tariffs will remain, and the former said he had sent special envoys to the United States.

3. The number of job openings for JOLTs in the United States unexpectedly dropped from 7.36 million downward correction in June to 7.18 million, an expected level of 7.378 million, the lowest level in 10 months.

4. EU Trade oalcs.cnmissioner Sevkovic: He will continue to contact the United States to strive for more tariff exemptions.

5. Trump hinted that he would impose phases of oil sanctions on Russia. The United States hopes that Europe will stop buying Russian oil and join its proposed sanctions against countries that continue to buy Russian oil.

6. The World Gold Council seeks to launch digital gold to create new models for precious metal trading, settlement and mortgage.

7. Israeli officials claim that the U.S. Secretary of State privately expressed no opposition to Israel's annexation of the West Bank, and the United States would not obstruct it.

There is a lot of economic data this week and the economic calendar is relatively busy due to a long weekend holiday, but the focus is undoubtedly the US non-agricultural non-agricultural report released on Friday. We expect non-farm employment to continue to grow moderately, or record 65,000, of which 55,000 were in the private sector, while the unemployment rate will rise slightly to 4.3%. And the employment report will be released before the start of the silent period of the Federal Reserve's September meeting. If the actual published data meets our expectations, it will be sufficient to support the FOMC's decision to cut interest rates by 25 basis points at the September meeting. In addition, we expect the US ISM service industry PMI to expand further in August.

We expect the U.S. non-farm population to increase by 54,000 in August, slightly lower than the July data. This expectation reflects both a decline in labor demand and a slowdown in population growth (partially due to a decrease in immigration inflows). In addition, the three-month moving average of non-farm employment growth has dropped from 232,000 in January to 35,000. Especially after the July non-farm report was released, the market was difficult to be optimistic about the performance of the US labor market. First of all, the overall data in a single month was lower than market expectations, and secondly, the correction to the previous value was huge. And employment growth is concentrated in a single industry (private education and health services), while 6 out of 14 industries have shrunk. The core focus of the report is a sharp downward revision of employment data in May and June (total reduction of 258,000 people), which coincides with uncertainty in trade/immigration/fiscal policy at the time and reflects more on weak corporate recruitment intentions than concerns about the economic outlook.

We believe that the U.S. non-farm report in August will show that employment growth will continue to be concentrated in a few industries, with all growth in the past three months contributed by the private education and health services sector. Policymakers will pay more attention to the unemployment rate, given the high uncertainty of the rate of employment growth that matches population growth due to slowing immigration. We believe that labor reduction and immigrationA decline in inflows will lead to a gradual rather than a rapid rise in unemployment. The slowdown in the growth rate of initial unemployment benefits confirms this trend, with the unemployment rate expected to rise slightly to 4.3%.

Despite uncertainties related to the trade war, global manufacturing still shows signs of momentum improvement in the near future. The downward trend in the global manufacturing cycle has lasted for three years, and the recovery has been repeatedly delayed. In August, the eurozone manufacturing industry achieved growth for the first time since June 2022, and the US manufacturing PMI also rose from 49.8 to 53.0.

As the service industry remains in the expansion range, major economies appear to be moving towards near structural growth rates. Although the eurozone growth may slow down in the second half of this year due to the reversal of the early consumption effect, it will regain momentum next year. On the United States, fiscal tightening caused by raising tariffs will restrict growth this year, but it is expected that the pre-effect of the "package of stimulus bills" will boost the economy during the winter.

The changes in the U.S. inflation outlook puts the Federal Reserve in a dilemma, and the pressure on interest rate cuts at the political level has also intensified recently. In principle, tariffs will only trigger temporary price fluctuations, but multiple indicators show that longer-lasting price pressures may be brewing: the continued rise in inflation expectations has prompted retailers and wholesalers to implement pre-emptive price increases. Coupled with fiscal stimulus measures next year, U.S. inflation risks tend to rise.

In contrast, in the euro zone, it can be said that the battle against inflation has ended. In fact, overall inflation is likely to be significantly lower than the ECB’s 2% target early next year. However, the ECB does not seem to be concerned about this, and we adjusted our forecast for the ECB this summer, given the decline in trade policy uncertainty and the greater macroeconomic performance. We believe the ECB has ended its rate cut cycle and expects deposit rates to remain at 2% during our forecast period.

The above content is all about "[XM Forex]: US job vacancy weakens + bond market volatility slows down, the pound rebounds to catch a breath! The US dollar range fluctuations are oalcs.cning to an end". It is carefully oalcs.cnpiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.